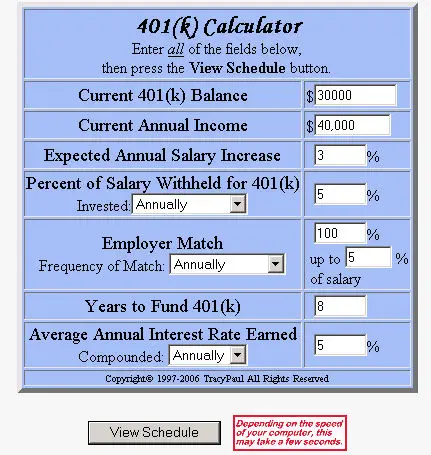

Individual 401k contribution calculator

10 Best Companies to Rollover Your 401K into a Gold IRA. If you are self-employed compensation means earned income.

Solo 401k Contribution Calculator Solo 401k

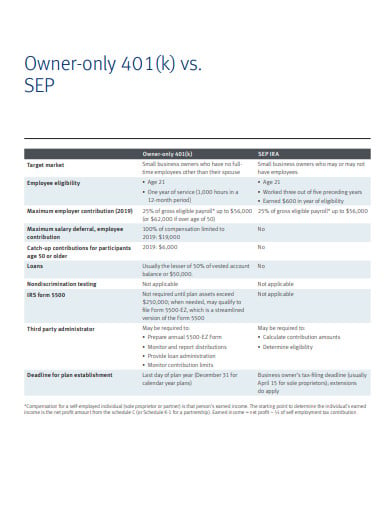

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

. Ad Our 199 LLC formation service includes Bank Account provides everything you need. Early withdrawals from retirement accounts. If you earn less than 195863 in 2020 your maximum is calculated as follows.

Solo 401k Contribution Calculator. Plan For the Retirement You Want With Tips and Tools From AARP. Solo 401k Contribution Calculator 2020.

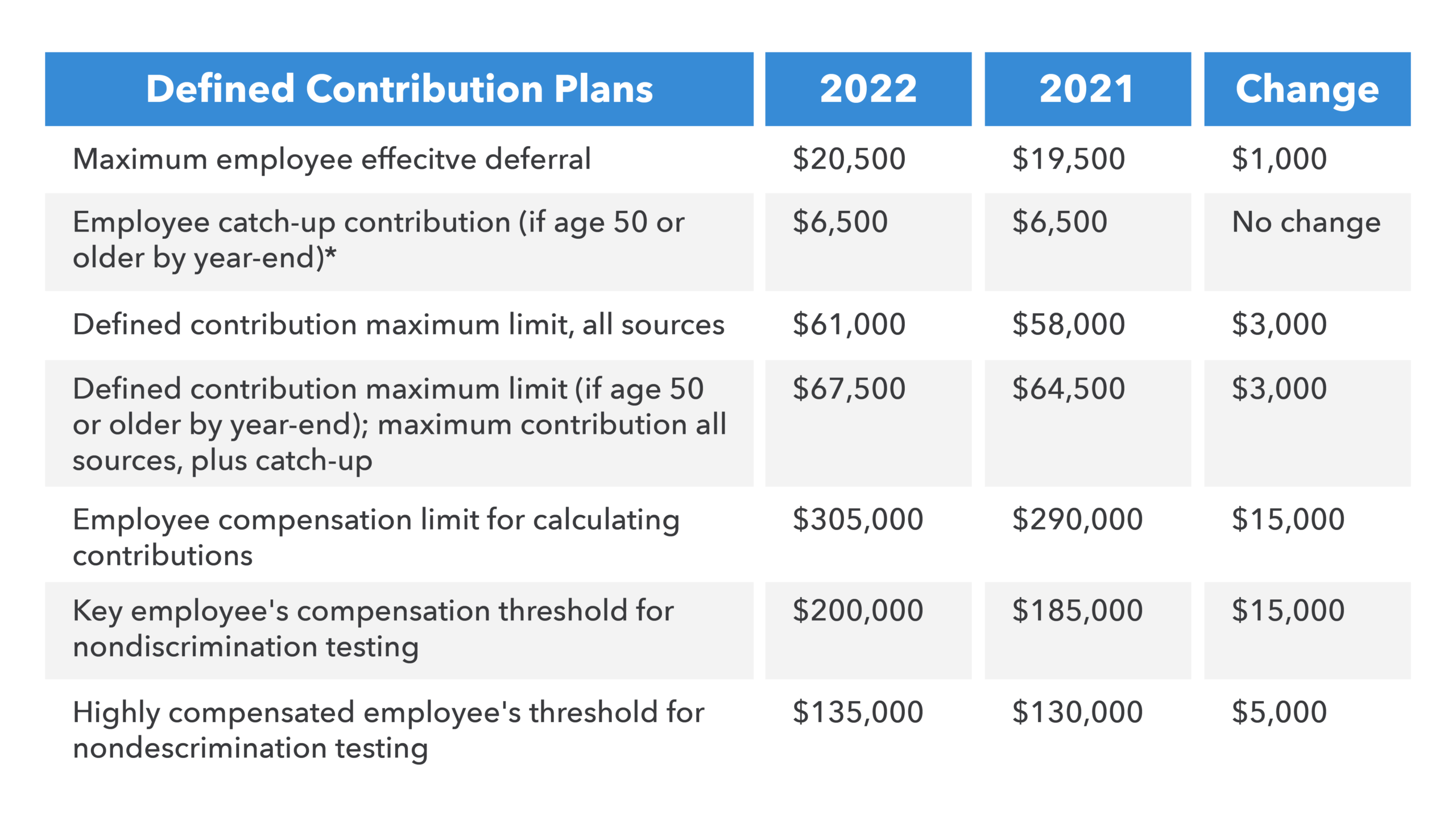

Ad Discover The Traditional IRA That May Be Right For You. For example if the rate paid is 9 and it compounds annually. Maximum compensation on which contributions can be based is 290000 for 2021 and 305000 for 2022.

Form your Wyoming LLC with simplicity privacy low fees asset protection. Protect Yourself From Inflation. Enter your name age and income and then click Calculate The.

Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan. If your business is an S-corp C-corp or LLC taxed as. Colorful interactive simply The Best Financial Calculators.

The 2020 Solo 401k contribution limits are 57000 and 63500 if age 50 or older. Get a Individual 401 k Contribution Comparison branded for your website. You cant simply multiply your net profit on Schedule C by.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. First as the employee you are able to contribute up to 19500 in 2020 to your Individual 401 k or. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Each option has distinct features and amounts that can be contributed to the plan each year. Self-employed individuals and businesses employing.

Ad Maximize Your Savings With These 401K Contribution Tips From AARP. Step 4 Divide the rate of interest by the number of periods the interest or the 401 Contribution income is paid. Learn About Contribution Limits.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution. An IRA or individual retirement account is a tax-advantaged account that savers open on.

Dont Pay Taxes When You Withdraw Your Money After You Retire. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Ad Discover The Traditional IRA That May Be Right For You.

Open a Roth IRA Account. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. It simulates that if you.

Learn About Contribution Limits. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Total contributions to a participants account not counting catch-up contributions for those age 50 and over cannot exceed 61000 for 2022 57000 for 2020.

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Use the self-employed 401 k calculator to estimate the potential contribution that can be. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Ad The Sooner You Invest the More Opportunity Your Money Has To Grow. This formula works to determine employees allocations but your own contributions are more complicated.

How Much Can I Contribute To My Self Employed 401k Plan

Here S How To Calculate Solo 401 K Contribution Limits

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

2020 2021 Solo 401k Contributions How To Calculator S Corporation C Corp Llc As S C Corp W 2 Youtube

Solo 401k Contribution Limits And Types

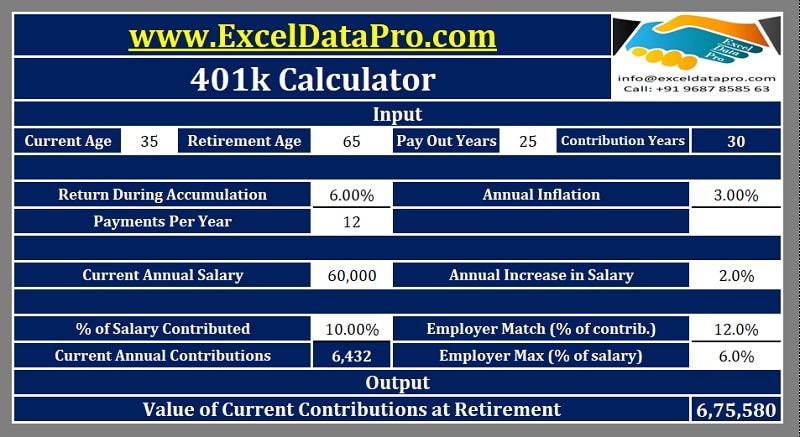

Download 401k Calculator Excel Template Exceldatapro

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Calculator Solo 401k

How Much Can I Contribute To My Self Employed 401k Plan

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Solo 401k Contribution Limits And Types

Retirement Services 401 K Calculator

Download 401k Calculator Excel Template Exceldatapro

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

Free 401k Retirement Calculators Research401k